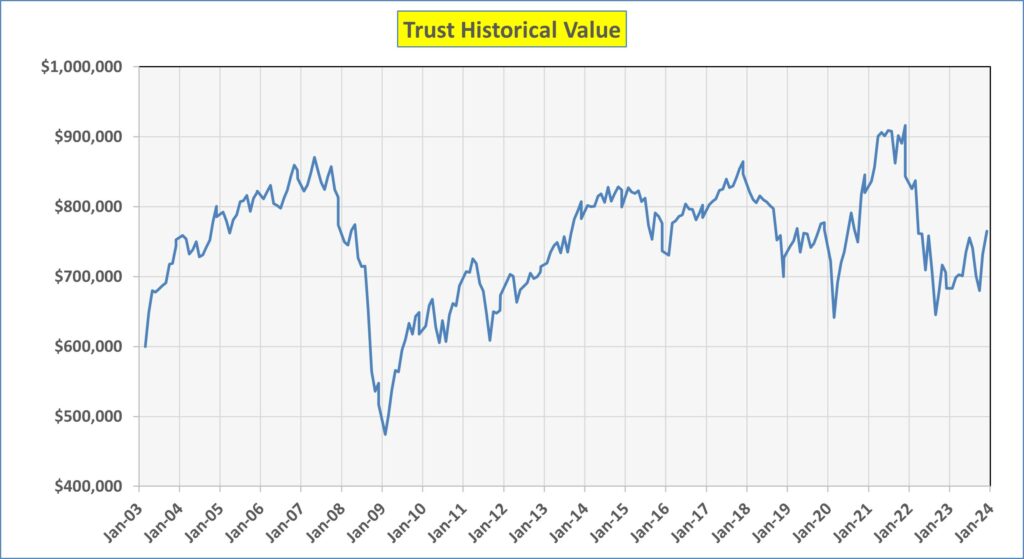

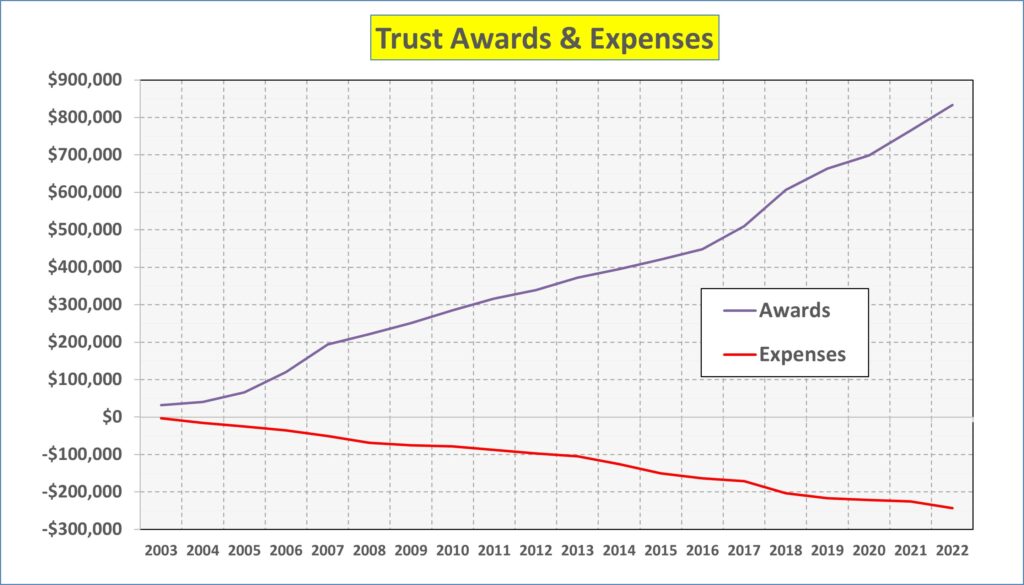

The Trust was funded with $600,000 on March 13, 2003. Over the years, the Trust has achieved remarkable gains while making significant awards to family members as they pursue their educations. At the end of 2023, the Trust was valued at $765,000, and we had distributed about $874,000 in awards, and had paid about $108,000 in taxes and about $47,000 for Vanguard’s Trust management. The chart below shows the historical trust value, while the 2nd chart shows the total trust awards and trust expenses. As you can see, at the end of 2023, the Trust is still valued at $688,000, $88,000 above where we started 20 years ago, despite distributing nearly $1.1 million in awards, taxes and fees.

The Trustee’s oversee the Trust fund and make decisions on awards. Obviously, we are pleased with the overall results and the current financial condition of the Trust. Nevertheless, we have had to make some difficult decisions over the years based on the ups and downs of the financial markets to ensure that the Trust assets are there for future generations, as this type of Trust will exist for about 100 years! Some of the key events and decisions are discussed below.

From 2003 to 2008, the trust achieved remarkable performance as the stock market motored ahead. This performance allowed us to make significant awards to those family members in college at the time, covering virtually all their costs.

However, the banking crisis in 2008 caused the stock market to suffer steep losses, taking a significant toll on the value of the Trust. Early in 2009, Trust assets had dipped to about $542,000, down from a high of $813,000! In reaction to this, the Trustees met and decided to limit awards to students to $7,500 per year. Time has proven that our strategy allowed us to weather the market storm during those years.

Trust value dipped to a low of $474,000 in early 2009 before beginning to recover. The markets turned around, and the Trust made solid gains in 2010 through 2017. Each year we set an overall award limit and did our best to adhere to that limit, while still making reasonable awards to family members. During this period, more family members were attending college. As such, in order to keep overall awards to a reasonable level, we had to limit individual awards. These limits started at $9,000 per year in 2010 and gradually increased to $14,000 per year in 2018.

Imposing these individual limits, of course, meant that those students who attended more expensive colleges during those years had significant out-of-pocket costs. This did not occur during the early years of the Trust, when students were fully reimbursed for their costs. Recognizing this inequity, the Trustees implemented a plan to make special awards to those individuals with substantial out-of-pocket costs. After evaluating year end performance, the Trustees decide whether to make some additional awards to those individuals. We were able to do this consistently between 2010 and 2017, providing additional awards between $1,000 and $4,000 to those individuals each year.

After the market peaked in early 2018, the Trust’s value had increased to about $850,000. However, the markets suffered significant losses for the remainder of 2018, and the Trust ended the year with a significant loss, dropping in value to about $700,000. As a result, we reduced the maximum award limit from $14,000 to $5,000 and made no special awards at year end.

2019 was a much better year for the market and by year end the Trust’s assets had grown to $782,000. This allowed the Trustees to increase individual award limits back to $9,000 and provide year end special awards again.

The Covid 19 epidemic started in early 2020, making for an interesting year for investing. The pandemic resulted in a precipitous drop in the Trust’s assets to $641,000 at the end of March 2020! However, the market recovered nicely, so by the end of 2020, the account was valued at about $845,000, up about $63,000 for the year. As such, we were able to increase individual awards to $12,000 per year and make additional special awards at year end. The market continued to increase in 2021, ending the year at $916,000, and allowing us to increase individual awards to $14,000 per year and make additional special awards at year end.

However, in late 2021, the market began to show signs of trouble, as inflation began to take hold. This accelerated throughout 2022 and caused the stock market to suffer steep losses, taking a significant toll on the value of the Trust. By the end of 2022, Trust assets had dipped to about $688,000, down from a high of $916,000 at the beginning of 2022!

So that’s where we stand today, again having to reduce awards as we await improved economic conditions.

Should you wish to download a copy of historical performance, follow the link below.